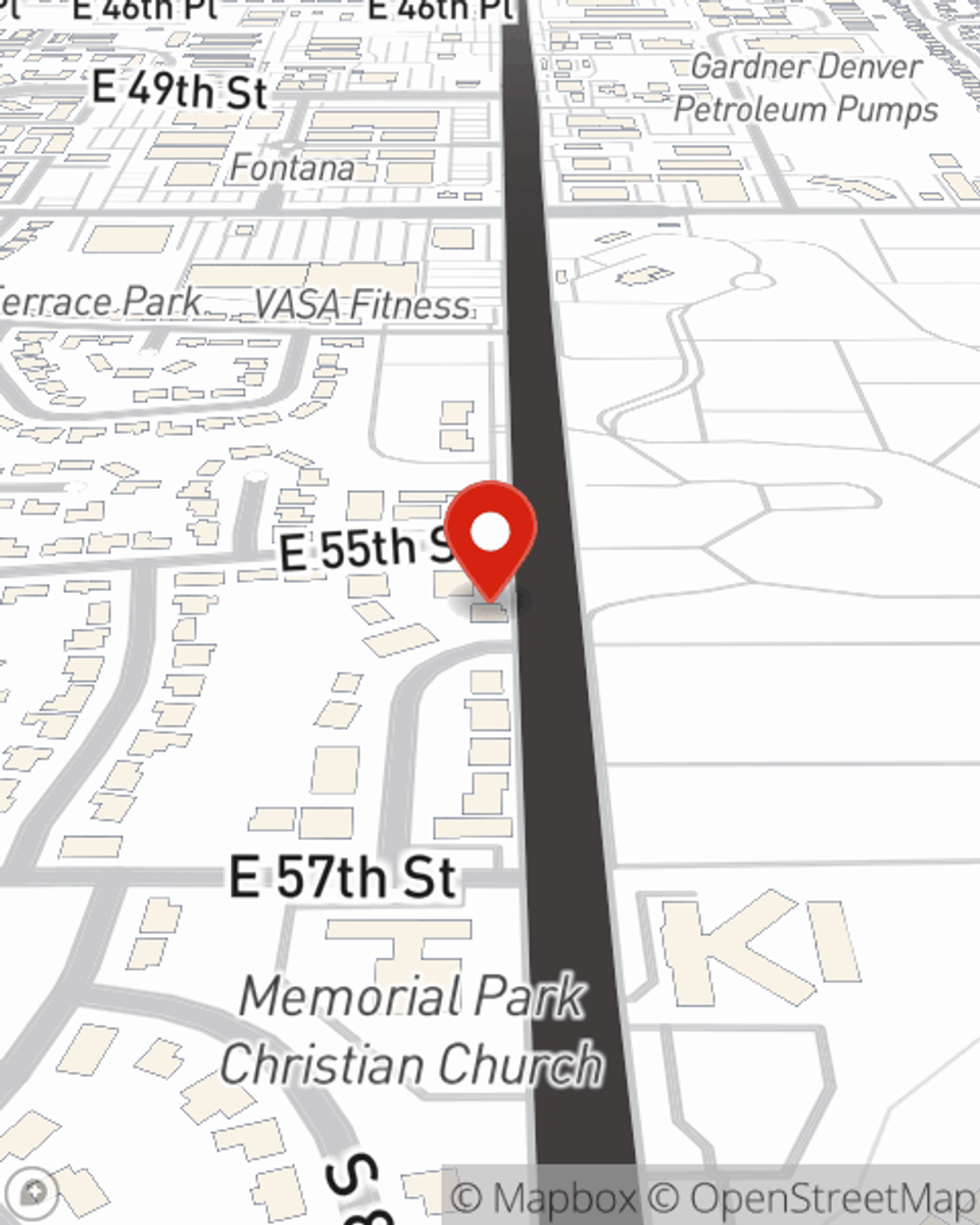

Business Insurance in and around Tulsa

One of the top small business insurance companies in Tulsa, and beyond.

Helping insure small businesses since 1935

Help Prepare Your Business For The Unexpected.

It takes courage to start your own business, and it also takes courage to admit when you might need guidance. State Farm is here to help with your business insurance needs. With options like business continuity plans, worker's compensation for your employees and a surety or fidelity bond, you can feel confident that your small business is properly protected.

One of the top small business insurance companies in Tulsa, and beyond.

Helping insure small businesses since 1935

Protect Your Future With State Farm

When you've put so much personal interest in a small business like yours, whether it's a farm supply store, a sign painting company, or a floral shop, having the right insurance for you is important. As a business owner, as well, State Farm agent Mark Welty understands and is happy to offer personalized insurance options to fit the needs of you and your business.

Agent Mark Welty is here to consider your business insurance options with you. Call or email Mark Welty today!

Simple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Mark Welty

State Farm® Insurance AgentSimple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.